The White Oak Global Advisors lawsuit settlement shook the financial world. It involved a pension fund and alleged mismanagement.

The case highlighted fiduciary responsibility in investment management. It resulted in a settlement exceeding $100 million. This case has far-reaching implications for the industry.

The Lawsuit

The New York State Nurses Association Pension Plan filed the lawsuit. They accused White Oak Global Advisors of mismanagement. The allegations were serious. They included breaches of fiduciary duty.

The pension plan claimed significant financial losses. White Oak denied the allegations initially. The lawsuit sought substantial damages.

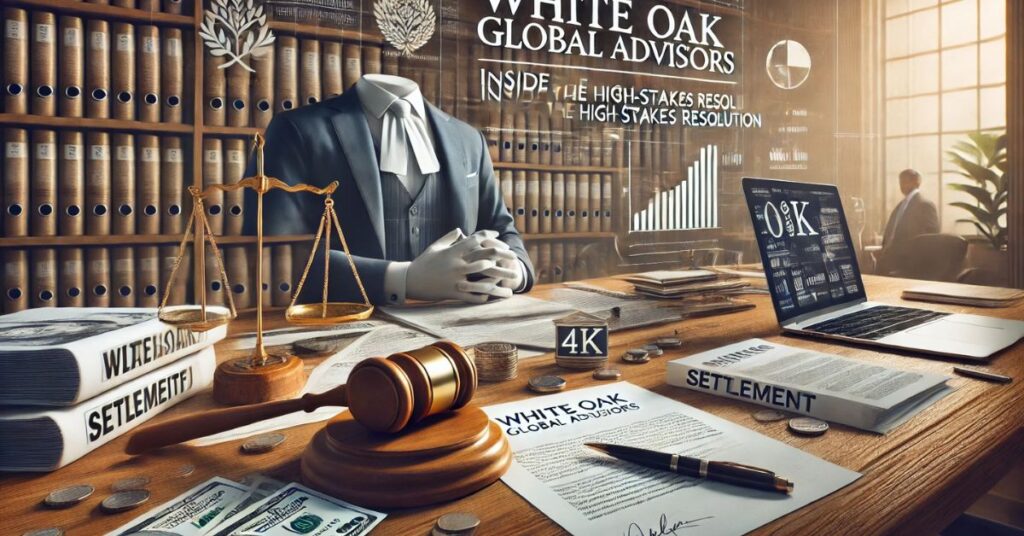

Here’s a table summarizing the important information about the White Oak Global Advisors lawsuit settlement:

| Key Information | Details |

|---|---|

| Plaintiff | New York State Nurses Association Pension Plan (NYSNA) |

| Defendant | White Oak Global Advisors |

| Year Filed | 2018 |

| Main Allegations | Mismanagement of pension funds, breach of fiduciary duty, ERISA violations |

| Settlement Amount | Over $100 Million |

| Breakdown of Settlement | – $96 million in returned assets – Relinquished management fees – Legal costs |

| Arbitration Outcome | Ruled in favor of NYSNA |

| Federal Judge | Lewis A. Kaplan |

| Court Decision | Largely upheld the arbitration award |

| Key Law Involved | Employee Retirement Income Security Act (ERISA) |

| Industry Impact | Increased scrutiny, calls for stricter oversight |

| Long-term Effects | Influenced ERISA enforcement, improved industry practices |

Arbitration and the Court’s Decision

The case went to arbitration. This process is common in financial disputes. The arbitrator carefully reviewed the evidence. They found in favor of the pension plan. The decision was a blow to White Oak.

The arbitrator ordered a substantial financial penalty. White Oak was told to return over $96 million. They also had to give up management fees. The decision was a victory for the pension plan.

A Federal Judge Upholds the Arbitration Award

The arbitration award needed court confirmation. Judge Lewis A. Kaplan heard the case. He reviewed the arbitrator’s decision carefully. The judge largely upheld the award.

This decision gave the award legal legitimacy. It was a significant moment in the case. The court’s decision reinforced the arbitrator’s findings.

The Importance of Fiduciary Duty in Investment Management

The case highlighted fiduciary duty importance. Investment managers have serious responsibilities. They must act in their clients’ best interests.

The case showed the consequences of breaching this duty. It emphasized the need for ethical investment practices. The financial industry took notice of this case.

The Impact of the White Oak Lawsuit on the Financial Industry

This lawsuit had wide-reaching effects. It served as a wake-up call. Many firms reassessed their practices. The case emphasized the importance of transparency.

It showed the need for strict compliance with regulations. The industry saw increased scrutiny from regulators. Many firms improved their internal controls.

Protecting Pension Funds and Beneficiary Interests

The case highlighted pension fund vulnerabilities. It showed the need for better protection. Pension fund administrators learned valuable lessons.

They increased their due diligence efforts. Many implemented stricter oversight measures. The case emphasized the importance of active management.

Steps for Holding Investment Firms Accountable

The case provided a roadmap for accountability. It showed how to challenge powerful firms. Investors learned to be more vigilant. They understood the importance of regular monitoring.

The case encouraged more active participation from beneficiaries. It showed the power of collective action.

The Role of Regulators in Ensuring Ethical Investment Practices

Regulators took note of this case. It highlighted gaps in oversight. Many called for stricter regulations. The case emphasized the need for proactive investigations. Regulators increased their scrutiny of investment firms. They implemented new monitoring strategies.

How Did White Oak Global Advisors Respond to the Lawsuit?

White Oak initially denied wrongdoing. They defended their investment strategies. The firm argued their actions were appropriate. As the case progressed, their stance softened.

They ultimately agreed to a substantial settlement. The firm’s reputation took a significant hit.

Reactions to the White Oak Case

The financial industry closely watched this case. Many experts weighed in with opinions. Some saw it as a landmark decision. Others worried about its impact on investment strategies.

The case sparked debates about fiduciary responsibilities. It became a topic of discussion in financial circles.

The Future of ERISA Enforcement

The case influenced ERISA enforcement. Regulators became more aggressive. They increased their focus on fiduciary duties. The case set new precedents. It likely influenced future enforcement strategies. Many expect stricter oversight in the future.

Potential Consequences for White Oak Global Advisors Beyond the Settlement

The settlement was just the beginning for White Oak. They faced reputational damage. Many clients likely reconsidered their relationships. The firm had to rebuild trust. They likely implemented new compliance measures. The case may have long-term effects on their business.

Safeguarding Retirement Security

The case emphasized retirement security importance. It showed the vulnerabilities in the system. Many called for stronger protections. The case highlighted the need for better oversight. It sparked discussions about pension fund management. Many hope it will lead to stronger safeguards.

Trust and Transparency in the Investment Landscape

The case underscored the importance of trust. It showed how quickly trust can be lost. The financial industry faced a reckoning. Many firms increased their transparency efforts. The case likely improved industry practices overall. It showed the value of open communication.

Frequently Asked Questions

What was the main allegation in the White Oak lawsuit?

The main allegation was mismanagement of pension funds and breach of fiduciary duty.

How much was the settlement in the White Oak case?

The settlement exceeded $100 million, including returned assets and fees.

Who filed the lawsuit against White Oak Global Advisors?

The New York State Nurses Association Pension Plan filed the lawsuit.

What law was central to this case?

The Employee Retirement Income Security Act (ERISA) was central to this case.

What was the immediate impact of this case on the financial industry?

The case led to increased scrutiny and calls for stricter regulatory oversight in the industry.

Conclusion

The White Oak Global Advisors lawsuit settlement was a landmark case. It highlighted the importance of fiduciary duty. The case resulted in a substantial financial penalty. It likely improved industry practices. The settlement exceeded $100 million.

This case will likely influence future regulatory efforts. It served as a wake-up call for the industry. The financial world will feel its effects for years to come. Investors and regulators alike learned valuable lessons. The case emphasized the need for constant vigilance in investment management.

Genesis Lorara, an esteemed writer and instructor with over five years of dedicated experience, brings insightful wisdom to “themartialartstips” website. With a deep-rooted passion for various fields, Genesis shares invaluable insights, techniques, and perspectives honed through years of practice and teaching, enriching the community with expertise and guidance across categories such as biography, headlines, business, information, blog, entertainment, and lifestyle.

Genesis Lorara, an esteemed writer and instructor with over five years of dedicated experience, brings insightful wisdom to “themartialartstips” website. With a deep-rooted passion for various fields, Genesis shares invaluable insights, techniques, and perspectives honed through years of practice and teaching, enriching the community with expertise and guidance across categories such as biography, headlines, business, information, blog, entertainment, and lifestyle.