NVIDIA Corporation, a titan in the tech industry, has captured investors’ attention with its remarkable stock performance. As a leader in GPU technology and artificial intelligence, NVIDIA continues to innovate and expand its market presence.

The stock market can be unpredictable, but NVIDIA has consistently demonstrated its resilience and growth potential. With applications ranging from gaming to data centers and autonomous vehicles, NVIDIA’s diversified portfolio positions it well for future success.

This article explores eight compelling benefits of investing in NVDA stock, as highlighted by Fintechzoom. From NVIDIA’s industry leadership to its strong financial performance and innovative edge, these advantages make a compelling case for considering NVDA in your investment portfolio.

What Is NVDA Stock?

NVDA stock represents shares of NVIDIA Corporation. NVIDIA is a tech giant known for its graphics processing units (GPUs). The company was founded in 1993. It has become a leader in AI and gaming technology. NVDA trades on the NASDAQ exchange. Investors can buy and sell NVDA shares easily. The stock symbol is “NVDA”.

NVIDIA’s main products are GPUs. These are used in various applications. Gaming is a big market for NVIDIA. AI and data centers also use NVIDIA’s tech. The company has expanded into other areas too. Self-driving cars use NVIDIA chips. So do many machine learning applications.

NVDA stock reflects the company’s performance. It also shows investor sentiment. The stock price can be volatile. This is common for tech stocks. NVDA has seen significant growth over the years. Many investors see it as a strong long-term investment.

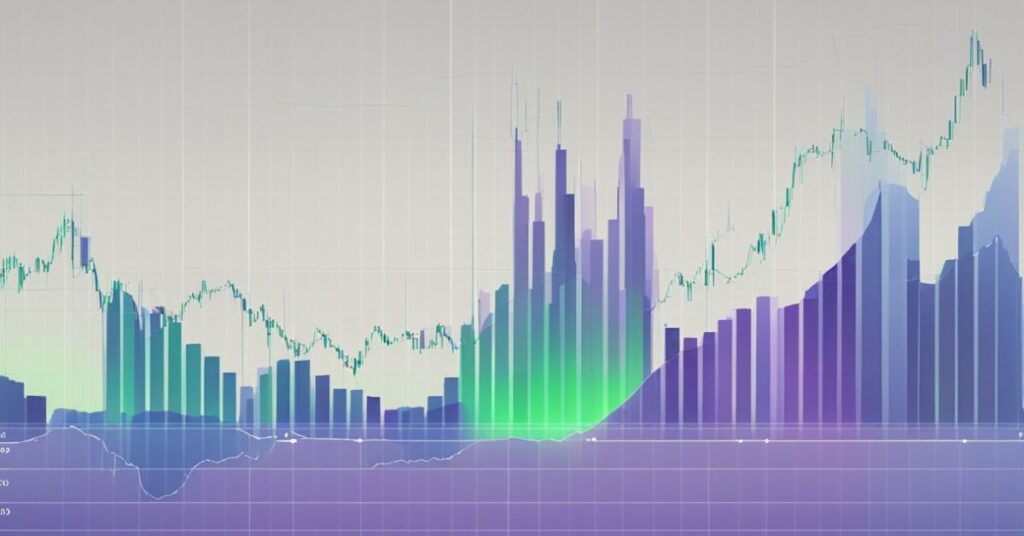

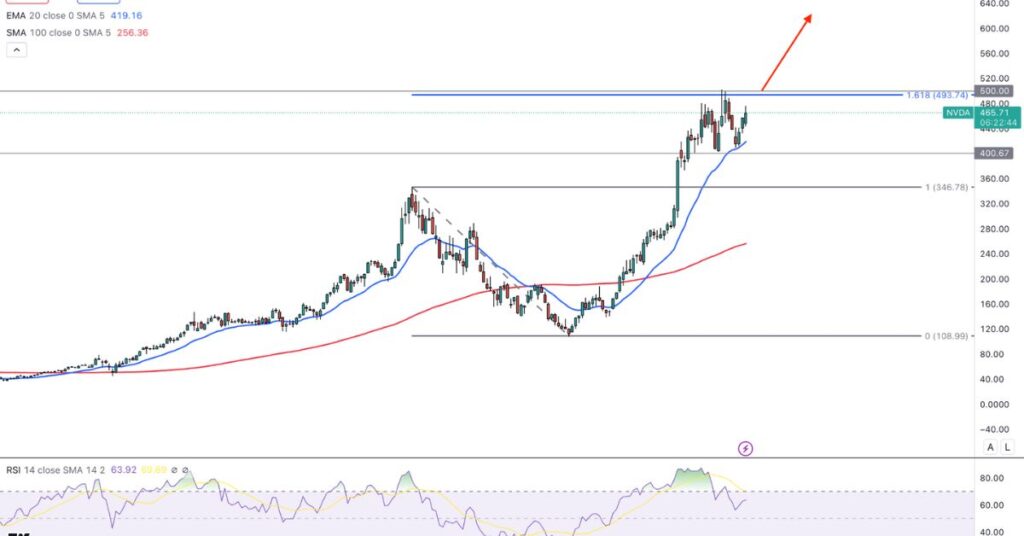

Growth of NVDA Stock

NVDA stock has shown impressive growth. Over the past decade, it has outperformed many tech stocks. The company’s focus on innovation has paid off. NVIDIA’s expansion into AI has boosted its value. Investors have rewarded this growth with higher stock prices.

Several factors have driven NVDA’s growth. The gaming boom has been a big contributor. NVIDIA’s GPUs are popular among gamers. The rise of cryptocurrency mining also helped. Miners use NVIDIA’s GPUs for their operations. More recently, AI has become a major growth driver.

NVIDIA’s financial performance has been strong. The company has reported consistent revenue growth. Profits have also increased over time. This has attracted more investors to the stock. NVDA is now considered a blue-chip tech stock. It’s part of many investment portfolios.

How Fintechzoom Helps You Invest in NVDA Stock?

Fintechzoom is a valuable resource for NVDA investors. It provides real-time stock data. Users can track NVDA’s price movements easily. Fintechzoom offers in-depth analysis of NVIDIA’s performance. This helps investors make informed decisions.

The platform offers various tools. These include stock charts and historical data. Investors can use these to analyze trends. Fintechzoom also provides news updates about NVIDIA. This keeps investors informed about company developments.

Fintechzoom’s NVDA stock forecast is popular. It uses advanced algorithms. These predict potential price movements. The forecast considers various factors. Market trends and company performance are included. This helps investors plan their strategies.

Fintechzoom NVDA Live Stock

Fintechzoom offers live NVDA stock tracking. This feature updates in real-time. Investors can see current prices instantly. The live stock feature shows bid and ask prices. It also displays trading volume.

Users can set price alerts on Fintechzoom. This notifies them of significant changes. The platform also shows pre-market and after-hours trading. This is useful for active traders. Fintechzoom’s live stock data is accurate and reliable.

The platform integrates with TradingView. This provides advanced charting tools. Investors can perform technical analysis easily. They can apply various indicators to NVDA charts. This helps in identifying potential entry and exit points.

Which Factors Affect the Price of Fintechzoom

Company performance significantly impacts NVDA stock price. Quarterly earnings reports are crucial indicators. Strong revenue growth and high profit margins often boost investor confidence.

Market trends play a vital role in NVDA stock fluctuations. The overall tech sector performance can influence NVIDIA’s stock. Trends in gaming, AI, and data center industries directly affect NVDA’s value.

Economic conditions have a broad impact on NVDA stock. Interest rates and GDP growth can influence tech spending. Global trade conditions may affect NVIDIA’s supply chain and sales.NVDA Stock?

1) Company Performance

NVIDIA’s financial results impact the stock price. Quarterly earnings reports are crucial. Strong revenue growth boosts investor confidence. Profit margins are also important. Higher margins often lead to stock price increases.

Product sales figures affect performance. NVIDIA reports GPU shipments regularly. Higher shipments usually mean better performance. The company’s market share in key segments matters. Gaining market share often leads to stock price growth.

2) Product Innovation

NVIDIA’s new products can move the stock price. Breakthrough technologies excite investors. The company’s R&D investments are closely watched. Successful product launches often boost the stock.

Innovation in AI chips is particularly important. NVIDIA leads in this field. New AI capabilities can significantly impact the stock. The company’s data center products are also crucial. Advancements here can drive stock growth.

3) Market Trends

The overall tech sector performance affects NVDA. When tech stocks rise, NVDA often follows. Industry trends in gaming and AI are important. Positive trends in these areas can boost NVDA.

Semiconductor industry dynamics matter. Chip shortages can impact NVIDIA. Changes in global demand for tech products affect the stock. NVDA is sensitive to broader market sentiment.

4) Economic Conditions

Interest rates influence NVDA’s stock price. Lower rates often benefit tech stocks. GDP growth impacts tech spending. Strong economic growth can boost NVIDIA’s sales.

Consumer spending trends are important. They affect demand for gaming products. Business investment in tech also matters. It drives demand for NVIDIA’s professional products. Global trade conditions can impact NVIDIA’s supply chain.

5) Competition

NVIDIA faces competition from other chip makers. AMD is a key competitor. Their product launches can affect NVDA stock. Intel’s moves in the GPU market are watched closely.

Competition in AI chips is intensifying. New entrants could challenge NVIDIA’s position. The company’s ability to maintain market share is crucial. Competitive pricing pressures can impact profitability.

6) Regulatory Changes

Government regulations can affect NVIDIA. Export controls on chip technology matter. They can impact NVIDIA’s global sales. Antitrust concerns in the tech sector are relevant.

Data privacy laws affect AI development. This can impact NVIDIA’s AI business. Environmental regulations on chip manufacturing are important. They can affect production costs. Trade policies between major economies influence NVIDIA’s operations.

Benefits of Investing in Fintechzoom NVDA Stock

Investing in NVDA stock through Fintechzoom offers real-time market insights. Fintechzoom provides up-to-date financial data and analysis. This helps investors make informed decisions about NVIDIA stock.

NVDA stock represents a leader in GPU and AI technology. The company has shown strong financial performance over time. Investors can potentially benefit from NVIDIA’s growth in emerging tech markets.

Fintechzoom’s tools allow for easy tracking of NVDA stock performance. Investors can set alerts and monitor price changes efficiently. The platform also offers forecasts and expert opinions on NVIDIA’s future prospects.

1) Industry Leadership

NVIDIA is a market leader in GPUs. It dominates the high-end gaming market. The company’s chips are preferred for AI applications. This leadership position offers strong growth potential.

NVIDIA sets industry standards. Its CUDA platform is widely used. The company often releases cutting-edge products. This keeps it ahead of competitors. Leadership in emerging technologies is a key advantage.

2) Innovation and R&D

NVIDIA invests heavily in research and development. This drives continuous innovation. The company regularly introduces new GPU architectures. Its focus on AI and machine learning is paying off.

Innovation extends beyond hardware. NVIDIA develops software platforms too. These enhance its products’ capabilities. The company’s innovations often create new markets. This provides multiple growth avenues.

3) Diverse Applications

NVIDIA’s products have wide-ranging applications. They’re used in gaming, AI, and data centers. The automotive industry uses NVIDIA chips. So do scientific research institutions.

This diversity reduces risk. It provides multiple revenue streams. NVIDIA can weather downturns in specific sectors. The company can capitalize on growth in various industries.

4) Strong Financial Performance

NVIDIA has a track record of strong financials. The company consistently grows revenue. Its profit margins are impressive for the tech sector. NVIDIA has a solid balance sheet.

The company generates significant cash flow. This allows for reinvestment in the business. NVIDIA also pays a dividend, rare for growth tech stocks. Its financial strength provides stability for investors.

5) Strategic Acquisitions

NVIDIA makes smart acquisitions. These expand its capabilities. The Mellanox acquisition strengthened its data center position. ARM acquisition (if completed) could be transformative.

Acquisitions help NVIDIA enter new markets. They bring in valuable intellectual property. The company integrates acquisitions effectively. This strategy supports long-term growth.

6) Growth in AI and Data Centers

NVIDIA is at the forefront of the AI revolution. Its GPUs are essential for AI training and inference. The company’s data center business is growing rapidly. This segment offers significant future potential.

AI adoption is accelerating across industries. This drives demand for NVIDIA’s products. The company’s software ecosystem for AI is a key advantage. Growth in cloud computing benefits NVIDIA’s data center business.

7) Stock Performance

NVDA stock has been a top performer. It has outpaced many tech indices. The stock has delivered strong returns to investors. Its growth has been supported by fundamental performance.

The stock has shown resilience during market downturns. It often rebounds quickly. NVDA’s performance attracts both growth and value investors. The stock’s liquidity makes it easy to trade.

8) Resilient to Economic Cycles

NVIDIA’s diverse business makes it relatively resilient. It’s not overly dependent on one sector. The company benefits from long-term tech trends. These trends often persist through economic cycles.

During downturns, some segments may remain strong. Gaming, for instance, can be countercyclical. NVIDIA’s financial strength helps it navigate tough times. The company can invest through cycles, emerging stronger.

The Impact of Market Trends on NVDA Stock

Market trends significantly influence NVDA stock performance. AI adoption drives demand for NVIDIA’s GPUs. The gaming industry’s growth boosts NVIDIA’s consumer sales.

Data center expansion creates opportunities for NVIDIA. Cloud computing relies heavily on NVIDIA’s technology. This trend supports long-term growth for the company.

Cryptocurrency mining affects NVIDIA’s stock volatility. Economic conditions impact overall tech spending. NVIDIA’s diverse applications help balance these market forces.

1) Technology Adoption

Rapid tech adoption benefits NVIDIA. The shift to cloud computing drives GPU demand. 5G rollout creates new opportunities for NVIDIA. Increased focus on edge computing suits NVIDIA’s products.

Virtual reality growth boosts GPU sales. Augmented reality applications use NVIDIA tech. The Internet of Things expansion creates new markets. NVIDIA is well-positioned for these trends.

2) Gaming Industry Growth

The gaming industry continues to expand. This drives demand for high-performance GPUs. NVIDIA’s GeForce products are industry leaders. eSports growth benefits NVIDIA significantly.

Cloud gaming services use NVIDIA technology. The company’s RTX platform enhances gaming experiences. New game releases often boost GPU sales. NVIDIA partners with major game developers.

3) Data Center Expansion

Data center growth is a key trend for NVIDIA. Companies are investing heavily in AI infrastructure. NVIDIA’s data center GPUs are in high demand. Cloud service providers are major customers.

The shift to AI in data centers benefits NVIDIA. Its GPUs excel in AI workloads. NVIDIA’s networking solutions complement its GPUs. The company offers complete data center solutions.

4) AI & Machine Learning

AI adoption is accelerating across industries. NVIDIA’s GPUs are crucial for AI applications. The company’s CUDA platform is widely used in AI. NVIDIA provides tools for AI development.

Machine learning workloads rely on NVIDIA GPUs. Industries like healthcare use NVIDIA for AI research. Autonomous vehicles depend on NVIDIA’s AI capabilities. The AI trend provides long-term growth potential.

5) Cryptocurrency Mining

Cryptocurrency mining has impacted NVIDIA. Miners use GPUs for crypto operations. This has led to demand fluctuations for NVIDIA products. The company has adapted its strategy accordingly.

NVIDIA now offers mining-specific products. This helps manage supply for gamers. Crypto trends can cause short-term stock volatility. Long-term, NVIDIA has reduced its reliance on mining demand.

6) Economic Conditions

Global economic conditions affect NVIDIA. Strong economies often boost tech spending. This benefits NVIDIA’s sales. Consumer confidence impacts gaming GPU demand.

Business investment trends are important. They drive data center and AI chip sales. International trade conditions affect NVIDIA’s global business. The company navigates these conditions effectively.

Frequently Asked Questions

How Is the Performance of the NVDA Stock Measured?

NVDA stock performance is measured through price changes over time. Comparison to market indices is common. Earnings per share growth is a key metric. Revenue growth and profit margins are also important.

How Can I Buy NVDA Stock?

You can buy NVDA stock through a brokerage account. Many online brokers offer NVDA trading. You need to open an account and fund it. Then you can place a buy order for NVDA shares.

Is NVDA a buy right now?

This depends on your investment goals and market analysis. Many analysts are positive on NVDA. The company’s strong position in AI is attractive. Always do your own research before investing.

What will Nvidia be worth in 5 years?

It’s impossible to predict exactly. Analysts make projections based on growth estimates. NVIDIA’s future value depends on market conditions and company performance. Long-term trends in AI and gaming will be important.

Is it too late to invest in Nvidia?

It’s never too late if you believe in the company’s long-term prospects. NVIDIA continues to innovate and grow. However, consider the current stock price and your risk tolerance. Diversification is always important in investing.

Conclusion

Investing in NVDA stock offers significant benefits. The company’s leadership in GPUs and AI is compelling. NVIDIA’s strong financials and innovation focus are attractive. The stock has shown impressive historical performance.

However, investors should consider risks. Market competition is intense. Economic factors can impact the stock. Regulatory challenges may arise. It’s crucial to do thorough research before investing.

NVIDIA’s future looks promising. The company is well-positioned for tech trends. Its role in AI and data centers offers growth potential. For many investors, NVDA remains an interesting opportunity.

Remember, all investments carry risk. Diversification is important. Consider your financial goals and risk tolerance. Consult a financial advisor for personalized advice. Stay informed about NVIDIA and market developments.

Genesis Lorara, an esteemed writer and instructor with over five years of dedicated experience, brings insightful wisdom to “themartialartstips” website. With a deep-rooted passion for various fields, Genesis shares invaluable insights, techniques, and perspectives honed through years of practice and teaching, enriching the community with expertise and guidance across categories such as biography, headlines, business, information, blog, entertainment, and lifestyle.

Genesis Lorara, an esteemed writer and instructor with over five years of dedicated experience, brings insightful wisdom to “themartialartstips” website. With a deep-rooted passion for various fields, Genesis shares invaluable insights, techniques, and perspectives honed through years of practice and teaching, enriching the community with expertise and guidance across categories such as biography, headlines, business, information, blog, entertainment, and lifestyle.