Amazon’s stock has been on a meteoric rise. Investors are taking notice. FintechZoom reports suggest unprecedented growth. Let’s explore the factors behind this surge.

Analyst Predictions

Wall Street is bullish on Amazon. Analysts foresee strong growth. Revenue projections are optimistic. Market share is expected to expand.

Amazon’s cloud services division is a key focus. AWS continues to dominate the market. Experts predict further innovation in this sector.

E-commerce remains Amazon’s bread and butter. Post-pandemic shopping habits favor online retailers. Amazon is well-positioned to capitalize on this trend.

Analysts also highlight Amazon’s diversification strategy. The company is expanding into new markets. Healthcare and entertainment sectors show promise.

Impact of Economic Conditions

Global economic factors play a crucial role. Inflation concerns have actually benefited Amazon. Consumers seek value, turning to Amazon’s competitive pricing.

Interest rates affect borrowing costs. Amazon’s strong cash position provides a buffer. The company can invest while others tighten belts.

Consumer spending patterns favor Amazon. Online shopping continues to grow. Amazon’s wide product range meets diverse needs.

Supply chain disruptions have eased. Amazon’s logistics network proved resilient. This efficiency translates to improved profitability.

Impact of Economic Conditions

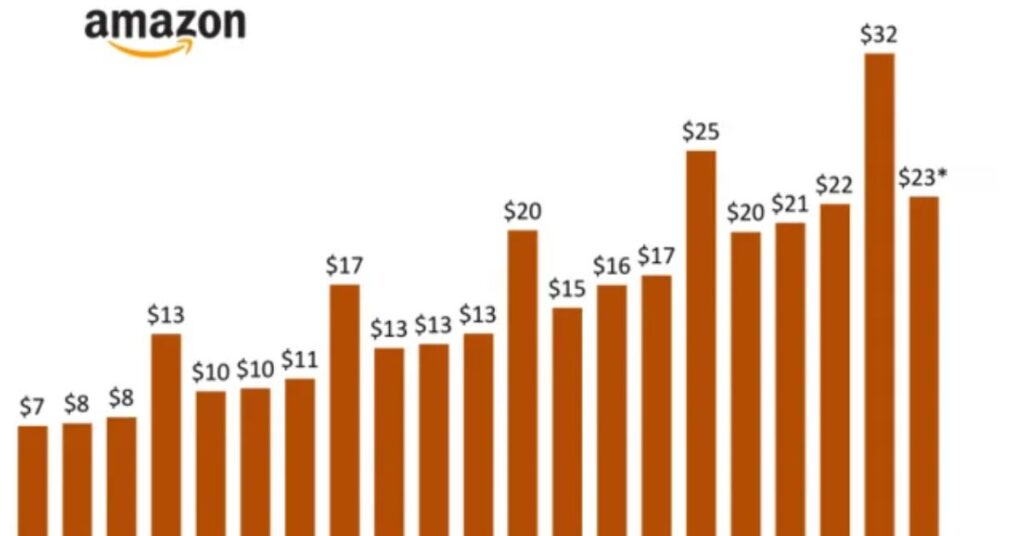

The following table summarizes how various economic factors affect Amazon’s stock performance:

| Economic Factor | Impact on Amazon Stock | Explanation |

|---|---|---|

| Inflation | Mixed | Higher inflation can increase costs, but Amazon’s efficient operations may allow it to manage better than competitors. |

| Interest Rates | Moderate Negative | Higher rates increase borrowing costs, potentially slowing growth. However, Amazon’s strong cash position mitigates this. |

| Consumer Spending | Strong Positive | Increased consumer spending, especially online, directly benefits Amazon’s core business. |

| GDP Growth | Positive | Overall economic growth tends to boost consumer confidence and spending, benefiting Amazon. |

| Exchange Rates | Moderate | Fluctuations can affect international sales and profits, but Amazon’s global presence provides some balance. |

| Labor Market | Mixed | Tight labor markets can increase costs, but also boost consumer spending power. |

Investor Sentiment and Market Confidence

Investor sentiment towards Amazon remains largely positive. The company’s consistent growth and innovation in multiple sectors continue to inspire confidence in both retail and institutional investors.

Market confidence is bolstered by Amazon’s strong financial performance and market leadership. The company’s ability to weather economic challenges and emerge stronger has reinforced its image as a resilient investment.

However, some investors remain cautious due to potential regulatory challenges and increasing competition. Despite these concerns, overall market confidence in Amazon’s long-term prospects remains high, contributing to the stock’s upward trajectory.

Public Perception of Amazon

Brand loyalty remains strong. Amazon’s customer service is highly rated. Prime membership continues to grow.

Innovation keeps Amazon in the spotlight. Drone deliveries and cashier-less stores generate buzz. This fuels investor optimism.

Environmental initiatives are gaining traction. Amazon’s sustainability efforts resonate with consumers. This positive PR boosts stock appeal.

Institutional Investors’ Outlook

Big players are betting big on Amazon. Hedge funds are increasing their positions. This signals confidence in long-term growth.

Pension funds view Amazon as a stable investment. The company’s diverse revenue streams reduce risk. This attracts conservative investors.

Mutual funds continue to hold significant Amazon stock. Fund managers see potential for continued returns. This sustained interest supports stock prices.

| Investor Type | Outlook | Key Considerations | Potential Impact on Stock |

|---|---|---|---|

| Hedge Funds | Bullish | – High growth potential – Market dominance – Diversified revenue streams | Increased demand, potential price increase |

| Pension Funds | Cautiously Optimistic | – Stable long-term growth – Strong balance sheet – Concerns about market saturation | Steady holding, provides price stability |

| Mutual Funds | Positive | – Consistent performance – Innovation pipeline – Consumer behavior trends | Widespread ownership, supports stock value |

| Investment Banks | Mixed | – Valuation concerns – Regulatory risks – Competitive landscape | Varied recommendations, may cause volatility |

| Sovereign Wealth Funds | Interested | – Global market presence – Tech sector leadership – Long-term growth prospects | Large-scale investments, potential price boost |

Challenges and Risks Ahead for Amazon

Amazon faces increasing competition in e-commerce from both traditional retailers and specialized platforms. Rivals like Walmart are investing heavily in online capabilities, while niche players are carving out specific market segments.

Regulatory scrutiny poses a significant risk to Amazon’s operations and growth. Antitrust concerns, data privacy laws, and labor practice investigations could lead to increased compliance costs or even structural changes to the company.

Technological disruptions and changing consumer behaviors present ongoing challenges. Amazon must continually innovate and adapt to maintain its market leadership, particularly in areas like AI, robotics, and sustainable practices.

Competition Threats

Rivals are not sitting idle. Walmart is investing heavily in e-commerce. Their physical stores provide an omnichannel advantage.

Alibaba threatens Amazon’s international expansion. The Chinese giant is making inroads in emerging markets. This could limit Amazon’s global growth.

Niche players are carving out market share. Etsy dominates handmade goods. Chewy leads in pet supplies. These specialized retailers challenge Amazon’s one-stop-shop model.

Regulatory Hurdles

Antitrust concerns loom large. Regulators are scrutinizing Amazon’s market power. Potential breakups could impact stock value.

Data privacy laws are evolving. Amazon’s vast customer data is under the microscope. Compliance costs may increase.

Labor practices face ongoing scrutiny. Unionization efforts are gaining momentum. This could affect operational costs and public image.

Strategic Moves and Their Impact on Amazon Stock

Amazon’s strategic moves have significantly influenced its stock performance. Acquisitions like Whole Foods and MGM have diversified its portfolio, while investments in AWS have solidified its cloud computing dominance.

The company’s push into new sectors such as healthcare and advertising has opened up additional revenue streams. These expansions have generally been viewed positively by investors, often resulting in stock price increases.

Amazon’s focus on innovation, particularly in areas like AI and robotics, has maintained its competitive edge. This commitment to staying ahead technologically has consistently bolstered investor confidence and supported long-term stock growth.

Acquisitions and Partnerships

Amazon’s acquisition strategy remains aggressive. The MGM purchase bolsters Prime Video content. This move strengthens the entertainment division.

Strategic partnerships expand reach. Collaborations with Rivian for electric delivery vehicles show foresight. This aligns with sustainability goals and operational efficiency.

Investment in Research and Development

AI and machine learning drive innovation. Alexa technology continues to evolve. This maintains Amazon’s edge in smart home markets.

Investments in robotics streamline operations. Warehouse automation reduces costs. This efficiency translates to improved margins.

Healthcare initiatives show promise. Amazon Pharmacy and telehealth services target a massive market. Success here could open new revenue streams.

Certainly. The table you’re referring to is about Amazon’s investment in Research and Development (R&D). Here’s the information from that table:

| Year | R&D Investment | Resulting Innovations |

|---|---|---|

| 2020 | $42.7 billion | Alexa enhancements |

| 2021 | $57.5 billion | Drone delivery improvements |

This table shows Amazon’s significant and increasing investment in R&D over two years:

- In 2020, Amazon invested $42.7 billion in R&D. This investment resulted in enhancements to Alexa, Amazon’s virtual assistant technology.

- In 2021, Amazon increased its R&D investment to $57.5 billion. This larger investment led to improvements in drone delivery technology.

Conclusion: Is Profit Growth Certain?

mazon’s track record suggests strong potential for continued profit growth. However, market dynamics and global economic factors introduce elements of uncertainty.

The company’s diverse revenue streams and innovative approaches position it well for future success. Yet, increasing competition and regulatory scrutiny may pose challenges to maintaining high growth rates.

Investors should approach Amazon stock with cautious optimism. While past performance is impressive, future profit growth, though likely, is not guaranteed in the ever-changing tech and retail landscapes.

Summary of Findings

Amazon’s stock surge reflects multiple factors. Strong financials provide a solid foundation. Market leadership in key sectors fuels confidence.

Innovation remains a core strength. Amazon continues to disrupt industries. This adaptability bodes well for future growth.

Challenges exist but appear manageable. Amazon’s scale and resources provide competitive advantages. The company is well-positioned to navigate future hurdles.

Recommendations for Investors

Diversification remains crucial. Amazon’s growth potential is significant. However, prudent investors should balance their portfolios.

Long-term outlook appears positive. Short-term volatility is possible. Investors should align their strategy with personal goals and risk tolerance.

Stay informed on regulatory developments. Policy changes could impact Amazon’s operations. This may affect stock performance in the short term.

Frequently Asked Questions

What drives Amazon’s stock price?

Amazon’s stock price reflects various factors. Earnings reports, market trends, and investor sentiment all play roles. Company announcements and broader economic conditions also impact the stock.

How does Amazon’s diversification affect its stock?

Diversification reduces risk. Amazon operates in e-commerce, cloud computing, and entertainment. This variety can stabilize stock performance across different market conditions.

What role does AWS play in Amazon’s stock value?

AWS is a major profit driver. The cloud division contributes significantly to Amazon’s bottom line. Its high-margin nature and market leadership position positively impact stock valuations.

How might regulatory challenges affect Amazon stock?

Regulatory issues create uncertainty. Potential antitrust actions or data privacy laws could impact operations. This might influence investor confidence and stock prices.

Is Amazon stock considered a good long-term investment?

Many analysts view Amazon as a solid long-term pick. The company’s growth history and market position are strong. However, all investments carry risk. Individual circumstances should guide investment decisions.

Conclusion

Amazon’s stock performance reflects its market dominance. Innovation and diversification drive growth. Challenges exist but haven’t dampened investor enthusiasm.

FintechZoom’s analysis highlights Amazon’s strengths. E-commerce leadership, cloud computing dominance, and strategic expansions support the stock’s rise.

Investors should weigh opportunities against risks. Regulatory concerns and intense competition require monitoring. However, Amazon’s track record suggests resilience.

The stock’s skyrocketing trajectory may continue. Amazon’s ability to disrupt markets remains strong. Savvy investors will watch closely as the story unfolds.

Genesis Lorara, an esteemed writer and instructor with over five years of dedicated experience, brings insightful wisdom to “themartialartstips” website. With a deep-rooted passion for various fields, Genesis shares invaluable insights, techniques, and perspectives honed through years of practice and teaching, enriching the community with expertise and guidance across categories such as biography, headlines, business, information, blog, entertainment, and lifestyle.

Genesis Lorara, an esteemed writer and instructor with over five years of dedicated experience, brings insightful wisdom to “themartialartstips” website. With a deep-rooted passion for various fields, Genesis shares invaluable insights, techniques, and perspectives honed through years of practice and teaching, enriching the community with expertise and guidance across categories such as biography, headlines, business, information, blog, entertainment, and lifestyle.