FintechZoom’s GM Stock Overview 2024 provides a comprehensive analysis of General Motors’ market performance and future prospects. This in-depth report combines real-time data, expert insights, and cutting-edge financial technology to offer investors a clear picture of GM’s position in the ever-evolving automotive industry.

The overview delves into GM’s history, current market challenges, and ambitious plans for electric and autonomous vehicles. It examines how global economic factors, technological advancements, and changing consumer preferences are shaping GM’s trajectory.

For 2024, the report focuses on GM’s transition towards sustainable mobility solutions and its impact on stock performance. It explores the company’s competitive position against both traditional automakers and new electric vehicle startups.

What is GM Stock?

GM stock represents shares of General Motors Company. It trades on the New York Stock Exchange. The ticker symbol is GM. Investors can buy and sell these shares. They reflect ownership in the company.

GM is a major automaker. It produces cars, trucks, and parts. The stock price changes based on company performance and market conditions.

History Of General Motors

General Motors began in 1908. William C. Durant founded it in Flint, Michigan. GM grew by acquiring other car companies. These included Buick, Cadillac, and Chevrolet. The company expanded globally in the 1920s. It played a key role in World War II.

GM faced challenges in the 1970s oil crisis. Bankruptcy struck in 2009. The company restructured with government help. Today, GM focuses on electric and autonomous vehicles.

Main Competitors

Ford Motor Company is GM’s historic rival. Toyota leads in global sales. Volkswagen Group competes in many markets. Tesla dominates the electric vehicle sector. Honda and Nissan offer strong competition. BMW and Mercedes-Benz compete in luxury segments.

Stellantis formed from a merger of Fiat Chrysler and PSA Group. Hyundai and Kia are growing competitors. These companies challenge GM in various vehicle categories and technologies.

Here’s a chart summarizing GM’s main competitors based on the information provided:

| Competitor | Key Strength |

|---|---|

| Ford Motor Company | Historic rival, strong in trucks |

| Toyota Motor Corporation | Global sales leader |

| Volkswagen Group | Broad market presence |

| Tesla, Inc. | Electric vehicle dominance |

| Honda Motor Co., Ltd. | Reliable, fuel-efficient vehicles |

| Nissan Motor Co., Ltd. | Strong in compact and midsize segments |

| BMW Group | Luxury vehicle segment |

| Mercedes-Benz (Daimler AG) | Premium and luxury vehicles |

| Stellantis N.V. | Diverse brand portfolio (Fiat Chrysler, PSA Group) |

| Hyundai Motor Company | Growing global presence, value-focused |

| Kia Corporation | Rapidly improving quality and design |

Price Fluctuation History

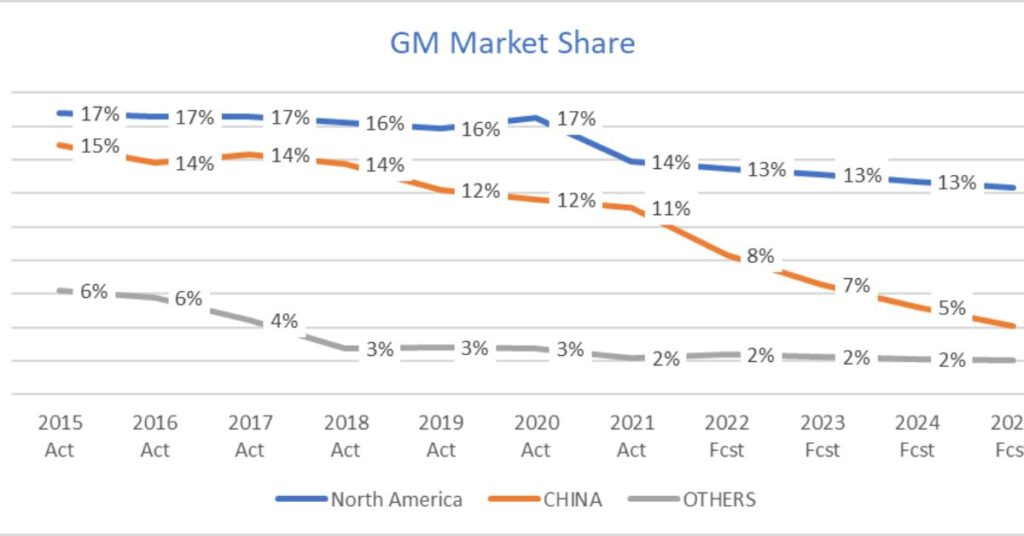

GM stock has seen significant price changes. In 2014, it opened at $40.00. The 2020 pandemic caused a drop to $14.32. The stock rebounded to $64.30 in 2021. Economic factors affect the price. Company performance influences fluctuations.

Industry trends play a role. Global events impact the stock. Investor sentiment causes short-term changes. Long-term price reflects GM’s strategic decisions.

Benefits Of Investment

Investing in GM stock offers potential growth. The company leads in electric vehicle development. GM has a strong brand portfolio. It pays dividends to shareholders. Global market presence provides diversification.

The stock can be part of a balanced portfolio. GM’s focus on innovation may drive future value. Its autonomous vehicle efforts could pay off. The company’s scale offers stability.

Risk And Challenges

GM faces intense competition. The shift to electric vehicles is costly. Supply chain disruptions can affect production. Economic downturns impact car sales. Regulatory changes pose challenges. Labor costs are a constant concern.

Technology shifts require large investments. Consumer preferences change rapidly. Debt levels need management. Geopolitical issues can disrupt global operations.

Future Trend Prediction 2025

GM aims for 30 new electric models by 2025. Autonomous driving technology could advance significantly. Market share in EVs will be crucial. Economic recovery may boost sales. Interest rates will affect financing.

Competition in the EV market will intensify. Battery technology improvements could be game-changing. Consumer adoption of EVs will influence success. GM’s restructuring efforts should show results. Analyst predictions vary widely for stock performance.

Why Fintechzoom Stands Out

FintechZoom offers comprehensive GM stock analysis. It provides real-time data updates. The platform combines financial and technological insights. User-friendly interface makes information accessible.

FintechZoom covers broader market trends affecting GM. It offers both fundamental and technical analysis. The site provides historical data for context. Expert commentary adds value for investors. FintechZoom stays ahead of industry news.

Real-Time Stock Market Updates

FintechZoom delivers instant GM stock price changes. It shows trading volume in real-time. Market sentiment indicators are updated constantly. Breaking news affecting GM is immediately reported.

The platform provides live market index data. It offers pre-market and after-hours information. Real-time charts help visualize trends. Alerts can be set for price movements. FintechZoom integrates multiple data sources for accuracy.

Price Fluctuation History

| Year | Opening Price | Highest Price | Lowest Price | Closing Price |

|---|---|---|---|---|

| 2014 | $40.00 | $41.85 | $28.82 | $34.91 |

| 2015 | $34.90 | $39.00 | $27.34 | $34.01 |

| 2016 | $33.99 | $38.16 | $26.69 | $35.15 |

| 2017 | $35.13 | $45.95 | $32.55 | $40.99 |

| 2018 | $41.00 | $45.00 | $30.56 | $33.39 |

| 2019 | $33.40 | $41.90 | $31.00 | $36.86 |

| 2020 | $36.89 | $46.71 | $14.32 | $41.58 |

| 2021 | $41.60 | $64.30 | $38.90 | $58.63 |

| 2022 | $58.65 | $67.21 | $30.33 | $34.37 |

| 2023 | $34.39 | $43.60 | $31.10 | $37.21 |

This chart shows the annual price fluctuations of GM stock from 2014 to 2023, including the opening price, highest price, lowest price, and closing price for each year.

Cryptocurrency and Blockchain Coverage

FintechZoom explores blockchain’s impact on the auto industry. It covers GM’s potential cryptocurrency initiatives. The platform analyzes how digital currencies affect car markets. Blockchain in supply chains is a key topic.

FintechZoom reports on automotive industry crypto investments. It examines tokenization in vehicle ownership. The site covers blockchain in autonomous vehicle development. Cryptocurrency’s effect on GM’s financial operations is explored. FintechZoom provides educational content on these technologies.

Fintech Innovations and Trends

FintechZoom tracks GM’s digital payment integrations. It covers in-car financial technology developments. The platform reports on GM’s fintech partnerships. AI in financial decision-making for auto purchases is analyzed.

FintechZoom examines GM’s data monetization strategies. It covers trends in auto insurance technology. The site reports on GM’s venture capital investments in fintech. Mobile app developments for GM finances are tracked. FintechZoom explores the future of car ownership models.

Fintechzoom’s Expert Analysis

Financial experts provide in-depth GM stock analysis. Technical analysts offer chart interpretations. Industry specialists comment on GM’s market position. Predictive models are developed by data scientists.

FintechZoom features interviews with GM executives. Economists discuss macroeconomic factors affecting GM. The platform offers peer comparison analyses. Regulatory experts explain policy impacts on GM. FintechZoom provides balanced bull and bear perspectives.

Empowering Investors with Data

FintechZoom offers comprehensive GM financial data. It provides tools for portfolio analysis. Customizable dashboards help track GM performance. The platform enables comparison with industry benchmarks.

It offers earnings report breakdowns. FintechZoom provides GM’s key performance indicators. Historical data helps identify long-term trends. Risk assessment tools aid investment decisions. The platform integrates with trading platforms for convenience.

Why Investors Love Fintechzoom

FintechZoom offers a one-stop shop for GM information. It provides both basic and advanced analytics. The platform is accessible on multiple devices. Community forums foster investor discussions.

FintechZoom offers educational resources for new investors. It provides timely alerts on significant GM events. The platform is known for its user-friendly design. It offers competitive pricing for premium features. FintechZoom continuously updates its offerings based on user feedback.

Navigating Economic Uncertainty with Fintechzoom

FintechZoom helps interpret economic indicators affecting GM. It provides scenario analysis for various economic conditions. The platform offers insights on GM’s recession resilience. Stress test simulations help assess GM’s financial health. FintechZoom tracks global economic factors impacting GM.

It provides guidance on portfolio diversification. The platform offers historical comparisons to past economic crises. It analyzes GM’s strategies for economic downturns. FintechZoom helps investors understand GM’s economic sensitivity.

Fintechzoom’s Role in the Future of Finance

FintechZoom is at the forefront of financial technology innovation. It integrates AI for predictive GM stock analysis. The platform explores quantum computing in financial modeling. Blockchain integration enhances data security and transparency. FintechZoom develops new visualizations for complex GM data.

collaborates with fintech startups for innovative features. The platform adapts to changing regulatory environments. FintechZoom leads in democratizing financial information. It continuously evolves to meet future investor needs.

Frequently Asked Questions

How often does FintechZoom update GM stock information?

FintechZoom updates GM stock information in real-time. Price changes, news, and analysis are provided instantly.

Can I set alerts for GM stock on FintechZoom?

Yes, FintechZoom allows users to set customizable alerts for GM stock price movements and important news.

Does FintechZoom offer mobile access for GM stock tracking?

FintechZoom provides a mobile app and mobile-optimized website for tracking GM stock on-the-go.

How does FintechZoom compare GM to other automakers?

FintechZoom offers comprehensive comparisons of GM with other automakers, including financial metrics and market position.

Is FintechZoom’s GM stock analysis suitable for beginners?

Yes, FintechZoom provides educational resources and basic analysis suitable for beginners, alongside advanced tools for experienced investors.

Conclusion

FintechZoom’s GM Stock Overview for 2024 offers a comprehensive look at General Motors’ market position. It combines historical context with future predictions. The platform stands out for its real-time updates and expert analysis.

FintechZoom’s coverage extends beyond traditional stock information. It explores fintech innovations impacting GM. The platform empowers investors with data-driven insights. FintechZoom’s user-friendly approach appeals to a wide range of investors.

It helps navigate economic uncertainties affecting GM. The platform’s role in shaping financial technology is significant. FintechZoom continues to evolve, meeting the changing needs of investors interested in GM stock.